The Misconception - Just Eat Takeaway

Please find the updated post here: https://newmooncap.substack.com/p/the-misconception-just-eat-takeaway

Why is the stock price down after its 4Q20

earnings print?

Why are people so shocked by the company’s

decision to take down profit to capture market share – didn’t the company

inform investors that they would do just such a thing, and history (Germany)

would suggest that is the right strategy?

In this post, I would delve into what I believe is the company’s strategy and why the company is poised to win in the long run. This deserves a post itself, rather than a twitter thread (I usually only post when I feel like the market really misunderstand a critical fulcrum issue on a company - see previous posts on SE and NFLX).

Debate

What’s Takeaway strategy? Somehow, Fintwit

has this conception that Takeaway is eBay or legacy GRUB – unwilling to change

with the times and maniacally focused on profits.

Part of this is the fact that Jitse

(Takeaway.com founder and CEO) kept saying that “logistics food delivery is not

profitable in Continental Europe”.

However, believing that logistics food

delivery is not fundamentally profitable and investing in logistics are

not mutually exclusive.

Jitse has repeatedly said that logistics is

necessary to keep consumers on the app, as consumers can get all the

restaurants that they want on a single app and hence much less likely to churn.

This logic is pretty straightforward:

- It’s Friday Night and I would like to get a cheeky Nandos

- However, there is a pandemic so I can’t go out to Nandos

- So, I search Just Eat for Nandos

- There is no Nandos on Just Eat

- So I Google ”Nandos delivery” and found that Deliveroo would deliver Nandos

- I download the Deliveroo app and order Nandos

In order for Just Eat to keep that customer

from going to another app, it has to offer logistics (Nandos). It is a customer

retention tool.

However, because it has value as a customer retention tool does not mean it is very profitable, if at all.

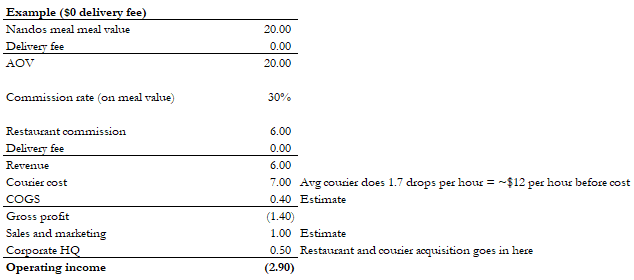

In fact, without a delivery fee, that order would be very unprofitable. It is only after implementing a $3 delivery fee that the business works (barely).

Okay…but if

logistics is so unprofitable/unappealing, why is JET trying to push Deliveroo

and Uber Eats out with a $0 delivery fee strategy?

The answer is simple:

to prevent logistics player from building a large enough customer base to enter

the marketplace business.

While it is true

that logistics is not profitable (much) as a standalone, it can be used as a

customer acquisition strategy to build a large enough customer base such that

it is possible for logistics players to acquire marketplace restaurants, which

are very profitable. JET is trying to eliminate this risk.

Strategy

The strategy seems really simple to me:

1. Run logistics at $0 delivery fee, forcing Deliveroo and Uber Eats to

match or lose market share

2. Deliveroo and Uber Eats won’t be able to match the delivery fee and

so would lose market share

3. After winning the market, raise delivery fee (Germany and

Netherlands) or instill minimum AOV (maybe $30) to make the unit economics work

JET can do this as the average logistics customers acquired also order from the highly profitable marketplace restaurants. Here is how it works:

1. I want to eat Nandos

2. Google Nandos and find that it is offered on JET for $0 delivery fee

3. Download the Just Eat app and order Nandos, but notice that other

restaurants are available

4. Order from other restaurants in the future (which are likely to be

marketplace restaurants)

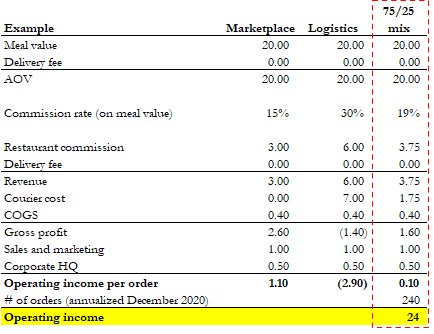

JET will still be profitable if 75% of orders are from marketplace, and 25% from logistics (assuming no delivery fee)

However, Uber and Deliveroo would lose 550mn pound per year cumulatively (~750mn USD) if they try to match.

However, we must

understand that Uber and Deliveroo are sub-scale relative to JET and so have

inferior cost structure. Moreover, Uber has been giving a lot of promos to

customers and those costs money. Using some reasonable assumptions, one might

get to a total burn rate of ~GBP 860mn (nearly US$1.2bn) per year simply to

match JET $0 delivery fee.

I do not think

that sort of burn-rate is tenable especially as JET is able to operate at this

unit economics indefinitely (as it is profitable). This is especially the case

as we are simply talking about the UK. Imagine this situation occurring all

across Europe (Spain, Italy, France) – the cumulative cash burn for the pair

would be immense. Certainly, Deliveroo would not be able to finance this

attrition war.

Moreover, JET has

the extremely profitable Germany and Netherlands business which generates

hundreds of million of EBITDA every year which can help in this “attrition

war”, and a super valuable multi-billion $ stake in iFood which can (will) be

monetized.

What if they

match?

Someone might then

say…well Uber has a lot of cash and a rideshare business which can be used to

finance a food delivery war in the UK. Losing 2bn/year is no problem for Uber.

The company has burnt MORE in the past!

That is true…but

to what end? To defend a sub-scale market position where it has 20% market

share (much of which were subsidized)? And a business that might break-even at best without a credible path to push out Just Eat?

And even if Uber

decides to match, it is likely that it would still lose market share as it

remains inferior on selection and coverage

So even if Uber and Deliveroo matches JET, they will still lose share because they are inferior in selection and coverage. What else can they do to defend their market position?

Here are some ideas (please reach out to me if you have any other ideas):

- Exclusivity contracts

- Pro: prevent JET from getting those restaurants, and create differentiation

- Con: very expensive – unit economics would be even worse.

- What can JET do to counter: if anything, JET is in the better position to win exclusivity contracts as it has superior coverage (McD would prefer to be exclusive with JET as JET has the largest customer base and cover all of the UK – lots of benefits including efficient nationwide co-marketing)

- Pro: Uber can sell a subscription service bundling rideshare with food delivery and groceries à offer no delivery fee to customers with the pass, locking in users

- Con: It does not actually make it cheaper because JET already has no delivery. Moreover, such a service likely covers a small % of the market as it is tailored to heavy rideshare users

- What can JET do to counter: already offer $0 delivery fee. Work with other rideshare companies as well to create a subscription service (e.g. Lyft with GRUB)

- Pro: align with the chains to offer a differentiated value prop (unique items or lower cost). The brand gets to tap an established logistics network and the logistics network get to capture demand

- Con: this might just be the worst thing a food delivery company can do in the long-run, especially one that is dependent on chains. The platform becomes a commodity and capture a small fee for each order, and there is no benefit of customer acquisition. At some point, all the food delivery platform would do this and the chain restaurants (large % of logistics order) will simply funnel it out to the lowest cost vendor

- What can JET do to counter: it would be ideal if competitors do not do this as it would be better for JET to capture a fee for offering the logistics in the future. However, if competitors do it, this basically ensures JET long term victory as it means competitors are giving up their inventory and has resigned to be a commodity (note that Deliveroo is already doing this with Nandos)

So, what

does all of this mean?

This means that JET is very likely to win

Europe and that the company will be incredibly profitable/valuable once it

wins. It will instill a delivery fee (as in Netherlands and Germany) once it

wins and likely minimum AOV to increase restaurant commission rate.

Please contact me in twitter if you think I

am missing something.

Great piece !! One remark: For Uber, the situation is slightly different: Uber Eats helps to a certain extent to increase work for their drivers and there might be some low CAC cross selling possible from their ride sharing customers. However this would only be a net positive if Uber Eats would turn somehow cash positive on a city level.

ReplyDeleteJET is clearly trying to prevent it. I agree with you that Jitse's strategy makes a lot of sense. Uber made the mistake to allow ride sharing competitors to gain market shares in some markets which then allowed these competitors to attack them in other markets (pre Covid).

Yup!

DeleteVery thoughtful analysis; Jitse's ability to adapt its strategy depending on the market situation is remarkable.

ReplyDelete@newmooncapital, would be great to connect

Hey. Hit me up on twitter.

Deletei am following you but cannot write you directly. could you DM me? asteeox. speak soon!

DeleteNice analysis, very insightful. Could you clarify what the difference is between Marketplace and Logistics?

ReplyDeleteMarketplace - Restaurants do their own delivery

DeleteLogistics - 1P (platforms do the delivery)

Nice work! One difference in our assumptions relates to the final table you have showing the blended P&L assuming 75% marketplace. I would be surprised if, even once JET wins, it is able to earn higher unit / contribution margins on logistics vs. marketplace. The $3 delivery fee on logistics orders makes sense, but given the largest logistics restaurants are scaled QSR chains I'd be very surprised if the take rate is double the marketplace take rate. If anything it should be the other way around as the marketplace restaurants are mostly mom and pops. Do you disagree?

DeleteNice work! One difference in our assumptions relates to the final table you have showing the blended P&L assuming 75% marketplace. I would be surprised if, even once JET wins, it is able to earn higher unit / contribution margins on logistics vs. marketplace. The $3 delivery fee on logistics orders makes sense, but given the largest logistics restaurants are scaled QSR chains I'd be very surprised if the take rate is double the marketplace take rate. If anything it should be the other way around as the marketplace restaurants are mostly mom and pops. Do you disagree?

ReplyDeleteNice analysis.

ReplyDeleteOne more idea how the logistics players could damage Jet:

Wouldn't the Uber eats/Deliveroo be able to get after the marketplace restaurants and put them on their platform without much effort? If they do it becomes an issue for Jet as they have competition in the marketplace segment. The marketplace restaurants have definitive an incentive to be on multiple platforms as these could be a multiplier for their revenues.

Hey buddy, good to see you bud, and btw, you're really doing some nice things with the informational content on chatbot cost calculator. This is probably one of my favorite posts that you've written about healthcare software development company.

ReplyDeleteBut thanks so much for the kind words, I'm just trying to saying what's on my mind about OTT app development cost. If it works out, then great.

ReplyDeleteNice post. I used to be checking constantly this blog and I am impressed! Extremely useful info particularly the ultimate section 🙂 I take care of such information a lot. I was seeking this certain information for a long time. Thank you and best of luck.

essay on cristiano ronaldo

Awesome Article thanks for share your valuable information and you are a restaurant owner build your business with features of our online food delivery software

ReplyDeletefood delivery software

Read about how to increase restaurant sales this winter

ReplyDeleteThanks for sharing this nice palace for eating healthy and tasty food. Launch a Justeat clone app with the greatest online meal delivery software for your target client base, allowing people to order food from their favorite neighborhood eateries with a few simple taps. Thank You so much.

ReplyDeleteThanks for sharing this blog here.very useful information for online food ordering system like Justeat clone script.

ReplyDeleteToken Development Company |

ReplyDeleteToken Development Services

BEP20 Token Development Company |

NFT Game Development Company |

NFT Token Development Company |

Cryptocurrency Development Services

Nice Article Thanks for sharing the post! Keep it up.

ReplyDeleteSolana NFT Marketplace Development |

Binance NFT Marketplace Clone |

Multichain NFT Marketplace Development |

NFT Music Platform Development |

NFT Art Marketplace Development |

Metaverse NFT Marketplace Development |

Nice Post!

ReplyDeleteCryptopunks Clone |

Sorare Clone |

Decentraland Clone |

Rarible Clone |

OpenSea Clone |

Cointool App Clone |

Axie Infinity Clone |

Zed Run Clone |

Excellent Post!

ReplyDeleteSolana NFT Marketplace Development |

Binance NFT Marketplace Clone |

NFT Marketplace Clone Development |

Multichain NFT Marketplace Development |

NFT Music Platform Development |

NFT Art Marketplace Development |

Metaverse NFT Marketplace Development |

You can create a TRC20 or TRC721 Token through our Tron token development services and they will work seamlessly with their Ethereum counterparts.

ReplyDeleteCreate your own DEX with like Uniswap our Uniswap clone script. Get decentralized exchange development from BlockchainX experts.Uniswap clone script

ReplyDeleteCryptoKitties Clone Script

ReplyDeleteAxie Infinity Clone Script

Zed Run Clone Script

NFT Game Development Company

Metaverse NFT Game Development

Solana NFT Game Development Company

NFT Game Development Company

ReplyDeleteMetaverse NFT Game Development Company

Axie Infinity Clone Script

Zed Run Clone Script

The migration platform works similarly to a DEX without the Automated Market Maker system. The New or V2 tokens are stored inside the migration smart contract and users can simply connect their web3 wallets to trustlessly migrate their tokens.Token Migration

ReplyDeleteTron token development is your best choice if you want all the functionalities of Ethereum, without the outrageous gas fees. Our Tron token development services allow you to create and deploy tokens on the tron network in minutes

ReplyDeleteI know this is an amazing post, it defines the true value of your knowledge. In fact, running a business is not common. People keep running to drive more business and generate more customers. At LBM Blockchain Solutions which is best Blockchain development company in Mohali , you can maintain a leading position with Blockchain development in Mohali . keep it up. I really think this article is amazing, I can't describe it in words. Also, if you need best crypto exchange development company in Mohali

ReplyDelete, do not delay in shaking hands with LBM Blockchain Solutions.

Coin Creation |

ReplyDeleteDeFi Token Development Company |

Smart Contract Development Company |

Amazing Post! Keep it Up.

ReplyDeleteBEP20 Token Development Company

NFT Token Development Company

Solana Token Development Company

Smart Contract Development Company

Polygon Token Development Company

NFT Music Marketplace Development Company

Token Development Company

ReplyDeleteBEP20 Token Development Company

Metaverse Token Development Company

Solana Token Development Company

White Paper Writing Services |

NFT Token Development Company |

ICO Software Development Services Company|

Our Dapp development services help you create robust and scalable decentralized applications. As a Dapp development company with several years of experience, we provide you with industry-leading blockchain architects, smart contract developers, and web3 developers.

ReplyDeleteDApp Development Solutions

Build decentralized app

Nft development Company

ReplyDeleteThis is Very nice informative blog, Thanks for Sharing.

ReplyDeleteToken Development Company

ERC20 Token Development Company

ERC721 Token Development Company

ERC777 Token Development Company

ERC1400 Token Development Company

ERC1155 Token Development Company

ERC998 Token Development Company

BEP20 Token Development Company

logo design company in Coimbatore

ReplyDeleteExcellent Blog Post.

ReplyDeleteToken Development

ERC20 Token Development Company

ERC20 Token Development

TRON Token Development Company

NFT Token Development Company

Metaverse Token Development Company

Polygon Token Development Company

ERC721 Token Development Company

Token Development

ReplyDeleteICO Development Company

Smart Contract Development Company

ERC20 Token Development Company

ERC721 Token Development Company

ERC1400 Token Development Company

NFT Token Development Company

BEP20 Token Development Company

good post

ReplyDeleteNice Post

ReplyDeleteNice post!

ReplyDeletecrypto coin development company

stablecoin development company

Thank you for an amazing post! 🧡

ReplyDeleteNFT Development Services

That was a very usefull information, thank you for such an awesome information, Checkout our Binance Website Clone

ReplyDeleteCoinbase clone script

Cryptocurrency Exchange Script

ReplyDeletebitcoin Exchange Script

Crypto Exchange Software

binance clone Script

binance clone Software

Thank you so much for sharing this informative post with us. Polygon Token Development Company

ReplyDeleteThat was a very usefull information, thank you for such an awesome information, Checkout our Binance Clone Script

ReplyDeleteThat was a very usefull information, thank you for such an awesome information, Checkout our Coinbase clone script

ReplyDeleteThat was a very usefull information, thank you for such an awesome information, Checkout our paxful clone script

ReplyDeleteCrypto Exchange Software

ReplyDeleteCryptocurrency Exchange Script

binance clone Software

bitcoin Exchange Script

binance clone Script

Thank you for such an awesome information,visit - cryptocurrency development company

ReplyDeletecryptocurrency wallet development company

Binance Clone App Development

Thanks for sharing this Informative Post!!!

ReplyDeleteP2P Cryptocurrency Exchange Development

Paxful Clone Script

Blockchain Fork Development

Very Nice Post.Ethereum Token Development Company

ReplyDeleteIDO Development Company

Launch your most prominent grocery delivery app with FreshDirect clone script app. We provide a white labelled grocery E-Commerce platform for retail businesses, markets in order to enhance the growth and reputation of the business.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThank you for sharing this informative article. Explore our Copy Trading Software Development The Comprehensive Guide to Embarking on a Successful Trading Journey: Get Started Today!!!

ReplyDelete"Your writings really demonstrate your depth of knowledge in the creation of cryptocurrency tokens! Your explanations' clarity and the depth of your knowledge never stop impressing me. Anybody interested in the crypto token development company can find a wealth of knowledge and inspiration from the books you've recommended. I was drawn to "Token Bridges" because it's a subject I've been wanting to learn more about. I appreciate you always providing such insightful content. You're a real expert in this area!"

ReplyDeleteExplore iMeta's cutting-edge, Axie Infinity Clone Script a groundbreaking software solution that mirrors the enchanting universe of Axie Infinity. Our white-label option, adaptable to your business logic, empowers you to dive into the thrilling realm of play-to-earn blockchain-based gaming. Revolutionize your venture and captivate players with a unique and customizable gaming experience.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteGreat blog! The seems like the perfect solution for entrepreneurs looking to break into the food delivery market with ease and efficiency. 🚀🍔

ReplyDeleteGreat blog! The JustEat Clone seems like the perfect solution for entrepreneurs looking to break into the food delivery market with ease and efficiency. 🚀🍔

ReplyDeleteAradığım cevabı burada buldum, süpersiniz.

ReplyDeleteThanks for the post! Launch your own Swiggy Clone .

ReplyDelete