Posts

Deliveroo $7bn valuation...Really?

- Get link

- X

- Other Apps

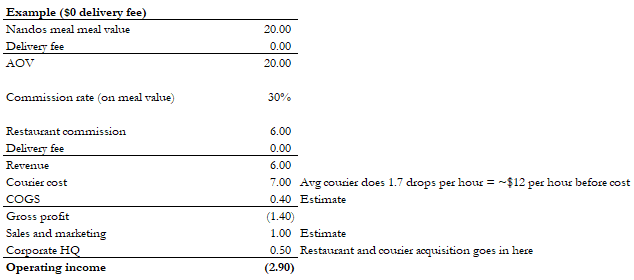

Please find updated post here: https://newmooncap.substack.com/p/deliveroo-7bn-valuationreally What about Deliveroo? $7bn valuation! And it is profitable! I find this valuation pretty absurd, although I am pretty sure whoever made this investment in Durable would still make money in the IPO pop. I have a few concerns: Notice that Deliveroo only said it is profitable on an operating level. What does this mean? Does this exclude corporate HQ costs such as restaurant and courier acquisition? How profitable would Deliveroo be post-Covid? I am guessing Covid benefited the company’s unit economics by increasing AOV, willingness to pay a delivery fee, and reducing CAC (S&M). MOST IMPORTANTLY , we know that Deliveroo is only profitable because the company do two things: (1) charge a high delivery fee, (2) lower courier fee per hour, and (3) shrink courier radius to ensure higher drop velocity and therefore further lowering delivery fee per drop This should allow Deliveroo to be pr...

The Misconception - Just Eat Takeaway

- Get link

- X

- Other Apps

Please find the updated post here: https://newmooncap.substack.com/p/the-misconception-just-eat-takeaway Why is Takeaway.com so hated? Why is the stock price down after its 4Q20 earnings print? Why are people so shocked by the company’s decision to take down profit to capture market share – didn’t the company inform investors that they would do just such a thing, and history (Germany) would suggest that is the right strategy? In this post, I would delve into what I believe is the company’s strategy and why the company is poised to win in the long run. This deserves a post itself, rather than a twitter thread (I usually only post when I feel like the market really misunderstand a critical fulcrum issue on a company - see previous posts on SE and NFLX). Debate What’s Takeaway strategy? Somehow, Fintwit has this conception that Takeaway is eBay or legacy GRUB – unwilling to change with the times and maniacally focused on profits. Part of this is the fact that Jitse (Takea...

Netflix thoughts -- part 2

- Get link

- X

- Other Apps

From a unit economic perspective Bears love to cite headline figures and comment that Netflix is overspending on content relative to peers. However, simple math suggests that this is simply not true on a per unit subscriber basis. Netflix has ~150 million subscribers and intends to spend 15 billion on content. This translates to ~$100 per subscriber . Disney, including Hulu, has about 45 to 50 million subscribers, and spends about ~$10 billion on content, once sports right are removed. This translates to ~$200-220 per subscriber Amazon Prime has about 25 to 30 million active subscribers and spends about ~$4.5 billion on content, about $150 to $180 per subscriber . Doing this paints an entirely different picture -- Netflix is actually spending the least among peers. Moreover, this only shows the content cost per subscriber, and not other costs which also scales meaningfully. This calculation also does not account for the fact that Netflix can a...

Netflix thoughts -- part 1

- Get link

- X

- Other Apps

What is the end game for Netflix? There has been an ongoing debate on what is going to happen to Netflix and the narratives range from the very bad (bankrupt) to the very good (Monopoly). Most participants debate on short-term issues when the focus should be on the end game. In my opinion, Netflix wins and the end game will likely be a global oligopoly between Netflix and Disney, with the former being far more profitable than the latter. This post and following parts will talk about this and the reasons behind it. What do customers care about? In this world where multiple content producers across various platforms are competing for eyeballs, customers have the negotiating power and can choose the content they want to watch. This is unlike the past where customers are essentially limited by the contents that are available to them, known as linear television. Things have changed when accessibility to cheap and fast internet resulted in a parad...

Sea Limited

- Get link

- X

- Other Apps

Background The bull case narrative for SE is known -- SE will win the food fight and dominate the South East Asia eCommerce industry. However, while the narrative is out there, it is unclear how that ties to the ultimate financials and valuation. Is this company still attractive at a $25bn valuation? $40bn valuation? In order to better understand the risk reward, we need to tie the narrative to the financials. This blog post is focus on this. My approach uses a combination of analog and market size estimate to triangulate the company's future earnings profile. Framing Shopee’s upside Formula: E-commerce TAM × Shopee Market Share → GMV × Shopee Take Rate → Shopee Revenue × NTM EV/Revenue Multiple → Shopee’s Value E-commerce TAM I believe that the TAM will be about $122bn in 2025. This was estimated through a combination of third-party sources ( LINK ) and analog in other regions. Note: Taiwan est. TAM ~20bn in 2025 ...